Letter to our Shareholders

To our shareholders, customers, and friends,

You will find the 2024 Consolidated Financial Statements for River Valley Community Bancorp and its wholly owned subsidiary, River Valley Community Bank (collectively referred to as the “Company”) HERE. Along with this report, we are providing additional context for you regarding the Company’s continued growth and development.

As we anticipated coming into 2024, deposit costs remained the primary challenge to margins and earnings for our Bank and the industry during the year. Stubborn inflation kept the Fed from lowering overnight Fed Funds until September. Since deposit costs are correlated to the rate set by the Federal Reserve on Fed Funds, they remained elevated compared to longer-term rates prolonging the pressure on margins. Additionally, increased depositor demand for yield and competition for deposits, from banks and non-bank financial institutions, have led to a shift from lower yielding checking accounts to higher yielding money market and time deposit accounts. As a result, while our Bank’s deposits increased by nearly 3% in 2024, our deposit costs were up $2.1 million or nearly 40% compared with 2023.

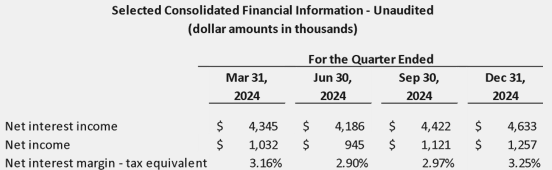

While these market factors had a large bearing on the bank’s reduced after-tax profits in 2024 compared to 2023, there are aspects of our results which began to offset the impact of our deposit costs in the latter half of the year. Notably, our loan portfolio grew by $55.6 million or 18.8% in 2024. This level of growth is in the top 93rd percentile of our FFIEC peer group of 1,297 banks across the country. The majority of the loan growth the bank achieved in 2024 was driven by our Roseville Loan Production Office (LPO) which we opened in 2Q 2023. Not only was our loan production strong, but the higher market rates earned on that production increased the overall yield of our loan portfolio, which increased the Bank’s Net Interest Income in the third and fourth quarters as depicted in the table below.

We believe the quarter ended June 30th, 2024, marked a turning point for our Bank during this interest rate cycle. With deposit costs appearing to moderate by year end, and the increased interest income generated on our loan portfolio, we believe the Bank is well positioned for continued growth in Net Interest Income and margin expansion in 2025.

Our success with our investment in our Roseville LPO has led to the decision to expand that investment by opening a full-service branch there. At the time of this writing, we have an application submitted to our regulators and we expect to have formal approval for the new branch in mid-April. If all goes as planned, we anticipate having the new branch opened later this year.

Our branch footprint reflects opportunity, and we have set our sights on surpassing $1.0 billion in assets! We’re proud of our full-service branch presence in Yuba City, Marysville, Grass Valley, Auburn—and soon, Roseville. Together, these vibrant markets represent approximately $15 billion in total deposits, offering significant upside for our Bank. This footprint and the close proximity of our branches enables efficient, relationship-driven growth. By staying focused, we believe we can capture meaningful market share through the customer-first service model that sets us apart.

We believe the future looks very good for our Bank and we are energized by the opportunities we see ahead. With the consolidation that has occurred in recent years, we enjoy an increasingly unique presence in our markets. We will grow by staying true with our delivery of highly valued, relationship-based and community-focused banking services. We remain committed to our customers, employees, and shareholders who have all contributed to our Bank’s success!

Thank you for your continued interest in and support of River Valley Community Bank!

Sincerely,

John M. Jelavich, President & Chief Executive Officer

Stephen F Danna, Chairman of the Board

Forward Looking Statements: This document may contain comments and information that constitute forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by such statements. Forward-looking statements speak only as to the date they are made. The Bank does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made.